[ad_1]

Be it a Bottega Veneta clutch or a Bvlgari ring, the Chinese love all issues costly. They are big spenders on the subject of luxurious brands, driving world gross sales for greater than a decade. But then got here COVID-19 and upended lives in China and much more. Amid lockdowns and gradual financial development, the Chinese luxurious lover needed to take a backseat (considerably). So then who stepped in? And what occurs now that the Chinese have deserted COVID-19 restrictions and are able to journey the world?

No one was spared the impression of the pandemic; not even the high-end brands. But because the world, together with China, is getting again to enterprise, luxurious giants appear to be treading with a little bit of warning. They are trying elsewhere.

Asia is a big market and they aren’t letting that go. They are turning to Japan, which has been the OG purchaser of luxurious items earlier than China grew to become the big spender, and South Korea, in accordance with a report in Bloomberg.

Graphic: Pranay Bhardwaj

All eyes on Japan

Long earlier than the Chinese, it’s the Japanese had the buying energy for high-end European brands. Now, style homes are paying extra consideration to it.

Louis Vuitton, which has reigned supreme in China, has a big collaboration with Japanese up to date artist Yayoi Kusama. They have remodeled shops internationally with Kasuma’s signature polka-dots and her replicas. The maison set a vibrant new pop-up in Kusama’s hometown of Harajuku, Tokyo earlier this month. The luxurious large launched merchandise first in Japan and China earlier than rolling them out worldwide, reviews Bloomberg.

LV just isn’t all. In Tokyo, the posh style scene is popping. Christian Dior’s Designer of Dreams exhibition got here to the Japanese capital in December and June will see Chanel host its Metiers d’Art style present.

Japan was the primary Asian nation to take to luxurious style. The income from the posh market this yr is estimated to quantity to $30.49 billion. AFP

In October 2020, the worldwide luxurious group Kering, which has brands like Gucci, Saint Laurent, Bottega Veneta, Balenciaga, Alexander McQueen and Brioni underneath its umbrella, opened its headquarters in Tokyo. And even Burberry, which didn’t have a lot of a presence in Japan till 2015, is making an attempt to determine itself within the nation, in accordance with the report.

Japan was the primary among the many Asian nations to adapt to high-end style. While China took over and is now the second-largest market after the United States, Japan nonetheless spends big cash on luxurious style.

Media reviews counsel that Japan is again on the expansion path and revenues from luxurious items gross sales are anticipated to rise yearly by 5.17 per cent (CAGR) between 2023 and 2027. The income from the posh market this yr is estimated to quantity to $30.49 billion, in accordance with market and shopper information platform Statista.

Graphic: Pranay Bhardwaj

Also learn: Indian luxurious brands: Can they entice world curiosity?

South Korea, setting the pattern

Consumers in South Korea are those which might be dictating style developments in Asia. They have emerged as the largest spenders of private luxurious per capita, in accordance with the funding financial institution Morgan Stanley. It is estimated that South Korean whole spending on private luxurious items grew 24 per cent in 2022 to $16.eight billion, or about $325 per capita. That’s excess of the $55 and $280 per capita spent by Chinese and American nationals, respectively, CNBC reviews.

Italian luxurious style home Moncler’s enterprise “more than doubled” within the second quarter of 2022 in contrast with earlier than the pandemic, and for Cartier-owner Richemont Group, gross sales grew by double digits in 2022 in comparison with a yr in the past, the report says.

In China, Prada’s retail enterprise declined by seven per cent due to the lockdowns however the “strong performance in Korea and South East Asia” helped mitigate it.

Seoul is rising as Asia’s new style showcase, with the world’s prime luxurious companies in search of to money in on the trend-setting recognition of South Korean popular culture. AFP

The enhance in buying energy has led to an increase within the demand for exorbitant merchandise in South Korea. “Appearance and financial success can resonate more with consumers in South Korea than in most other countries,” analysts wrote within the Morgan Stanley report.

Plus, the Koreans don’t have any hesitation to flaunt what they’ve. CNBC quotes a McKinsey survey that discovered that solely 22 per cent of Korean respondents think about displaying off luxurious items to be in dangerous style, in contrast with 45 per cent of Japanese and 38 per cent of Chinese.

The Chinese conundrum

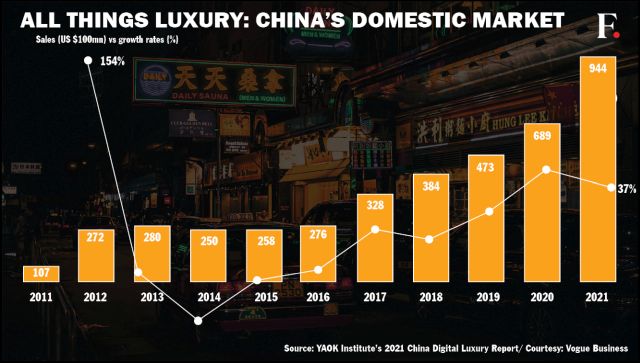

The pandemic and the lockdowns slowed China down. But customers, who couldn’t journey, continued to spend on luxurious items at residence. While there was a stoop in total Chinese retail gross sales, luxurious items gross sales registered development.

Sales of private luxurious items in mainland China rose by 36 per cent to 471 billion yuan ($73.59 billion) in 2021 from the prior yr, in accordance with consultancy Bain & Company’s annual report on the posh sector.

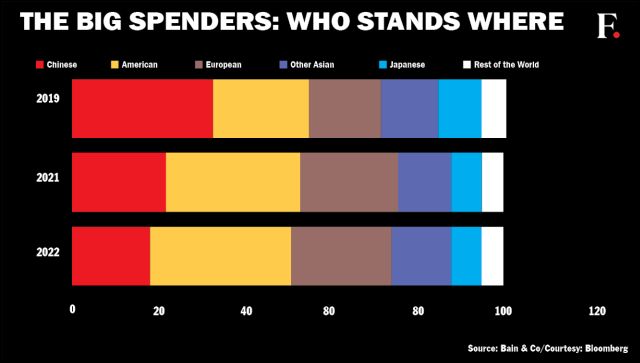

However, 2022 didn’t bode properly for the high-end Chinese shopper. Bloomberg Intelligence analysis estimated that China’s luxurious items market share might have halved in 2022 due to shuttered shops within the first half of the yr and a reticence from clients to return to shops past the preliminary reopening euphoria, reviews The New York Times.

China’s zero-COVID coverage hit the high-end market in 2022. AFP

But will the scenario change now that China has opened up? High-end retailers are reluctant as a result of the market is risky. The doable financial slowdown can also be taking part in on their minds.

It stays to be seen if the uncertainty within the nation and the federal government’s name for “common prosperity” that seeks to scale back the yawning wealth hole within the nation will affect the shopping for habits of its folks, in accordance with Bloomberg.

Also learn: Why luxurious model Manolo Blahnik has waited 22 years to promote footwear in China

The way forward for luxurious purchasing

Before the pandemic, Chinese consumers didn’t buy luxurious items on the mainland due to greater costs. A bigger a part of the gross sales – 70 per cent – occurred in Paris, London, Seoul and Hong Kong. And whereas China has now opened its borders, the surge in COVID-19 circumstances has made nations cautious of Chinese travellers with many imposing visa restrictions.

“The return of the Chinese to Europe, where prices are lower, will take some time,” Luca Solca, senior analysis analyst at Bernstein, informed Reuters.

So the place does the Chinese luxurious shopper go from right here?

While luxurious brands are holding their choices open, they aren’t turning a blind eye to China. In early January, as Beijing introduced to loosen journey restrictions, share costs of luxurious brands jumped.

As China reopens, it stays to be seen if the pandemic has altered the shopping for habits of the posh shopper. AFP

The Lunar New Year is across the nook and everybody from Prada to Gucci is leaping on “The Year of the Rabbit” bandwagon. While there is perhaps restrictions to journey abroad, there isn’t any stopping them from flocking to the nation’s native luxurious vacation spot, the tax-free island of Hainan.

In November final yr, a research by Bain & Co stated that Chinese consumers will make up 40 per cent of luxurious customers by 2030. “China (and Chinese) are a fundamental growth driver in the long-term,” stated Federica Levato, senior companion and EMEA Leader Fashion & Luxury at Bain & Co.

While Japan and South Korea are a sound guess, it appears just like the Chinese luxurious shopper is right here to remain.

With inputs from companies

Read all of the Latest News, Trending News, Cricket News, Bollywood News,

India News and Entertainment News right here. Follow us on Facebook, Twitter and Instagram.

[ad_2]

Source hyperlink